08 September, 02:03

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

08 September, 02:57

In response Vincent Kennedy⍟ to his Publication

There was a huge disconnect!!

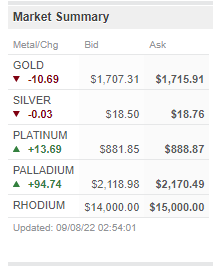

So now, we see the stock market climbing (ATM), but Gold and Silver down...

Gold and Silver will continue to drop for a short period...

Let the Cat bounce, I say!

So now, we see the stock market climbing (ATM), but Gold and Silver down...

Gold and Silver will continue to drop for a short period...

Let the Cat bounce, I say!

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

Water Mark

@Watermark

08 September, 03:18

In response Charlie Lost in the Woods⍟ to his Publication

Hi, Charlie.

I'm thinking that these movements are both reactionary to the value of the dollar internationally rather than anything 'anon' related. I'm watching the bond market and the 10 year yield for signs of petrodollar implosion. When the 10yy goes up rapidly and steadily it will signal that the fed has finally lost control. PM's will then react accordingly.

I'm thinking that these movements are both reactionary to the value of the dollar internationally rather than anything 'anon' related. I'm watching the bond market and the 10 year yield for signs of petrodollar implosion. When the 10yy goes up rapidly and steadily it will signal that the fed has finally lost control. PM's will then react accordingly.

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

Hi W.M.

I concur with you on this.

Here is why I say that,

Hyper inflation is affecting the Petro Dollar, it hurts the banks because people stop buying luxury items and less at the grocery store. That is a reflection of the U.S, economy here ...

but globally, so many countries have been hedging against the U.S. dollar for many years. Pakistan, India, Russia, and a few others have been buying gold for at least a decade. Some trade oil for Gold/Rubles. It came out yesterday China and Russia will do Yuan.

It did not make news until the last year or so, but they have stockpiled P.Ms.

In Tandem, J.P. Morgan was buying silver as a hedge, but they are in two major lawsuits right now. They ill nt be able to hold P.M.s down as we slide of the edge of the cliff.

The other aspect is "Futures" and Gold/Silver certs... Once people realize the jig is up, they will try to cash in all at once. It will create a vacuum. GOing to be bumpy, to say the least.

I concur with you on this.

Here is why I say that,

Hyper inflation is affecting the Petro Dollar, it hurts the banks because people stop buying luxury items and less at the grocery store. That is a reflection of the U.S, economy here ...

but globally, so many countries have been hedging against the U.S. dollar for many years. Pakistan, India, Russia, and a few others have been buying gold for at least a decade. Some trade oil for Gold/Rubles. It came out yesterday China and Russia will do Yuan.

It did not make news until the last year or so, but they have stockpiled P.Ms.

In Tandem, J.P. Morgan was buying silver as a hedge, but they are in two major lawsuits right now. They ill nt be able to hold P.M.s down as we slide of the edge of the cliff.

The other aspect is "Futures" and Gold/Silver certs... Once people realize the jig is up, they will try to cash in all at once. It will create a vacuum. GOing to be bumpy, to say the least.

04:52 PM - Sep 08, 2022

In response Water Mark to his Publication

Only people mentioned by Quilibet in this post can reply

Water Mark

@Watermark

09 September, 12:38

In response Charlie Lost in the Woods⍟ to his Publication

Agree on all counts, Charlie.

When I think of the strength of the petrodollar in this case, I now compare it to western currencies (Euro, Pound). With Russia exiting to sell their oil in other currencies (and BRICS happily joining up and becoming middlemen to sell to the EU with their markup) it has created a second world marketplace; punishing CB's and manipulating western governments.

At the same time US reserves have been put off limits by the Green New Deal; driving prices even higher (and pissing off nearly everyone in the US against the DNC).

This will move insane amounts of wealth back into Russia (which was in effect stolen from them over decades of Kharzarian communism). They will need this money to prosecute their military actions in Ukraine (and eventually further south into Israel).

Kinda like it is all planned...

When I think of the strength of the petrodollar in this case, I now compare it to western currencies (Euro, Pound). With Russia exiting to sell their oil in other currencies (and BRICS happily joining up and becoming middlemen to sell to the EU with their markup) it has created a second world marketplace; punishing CB's and manipulating western governments.

At the same time US reserves have been put off limits by the Green New Deal; driving prices even higher (and pissing off nearly everyone in the US against the DNC).

This will move insane amounts of wealth back into Russia (which was in effect stolen from them over decades of Kharzarian communism). They will need this money to prosecute their military actions in Ukraine (and eventually further south into Israel).

Kinda like it is all planned...

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396