Dan Auito

@DanUSCG

22 June, 09:26

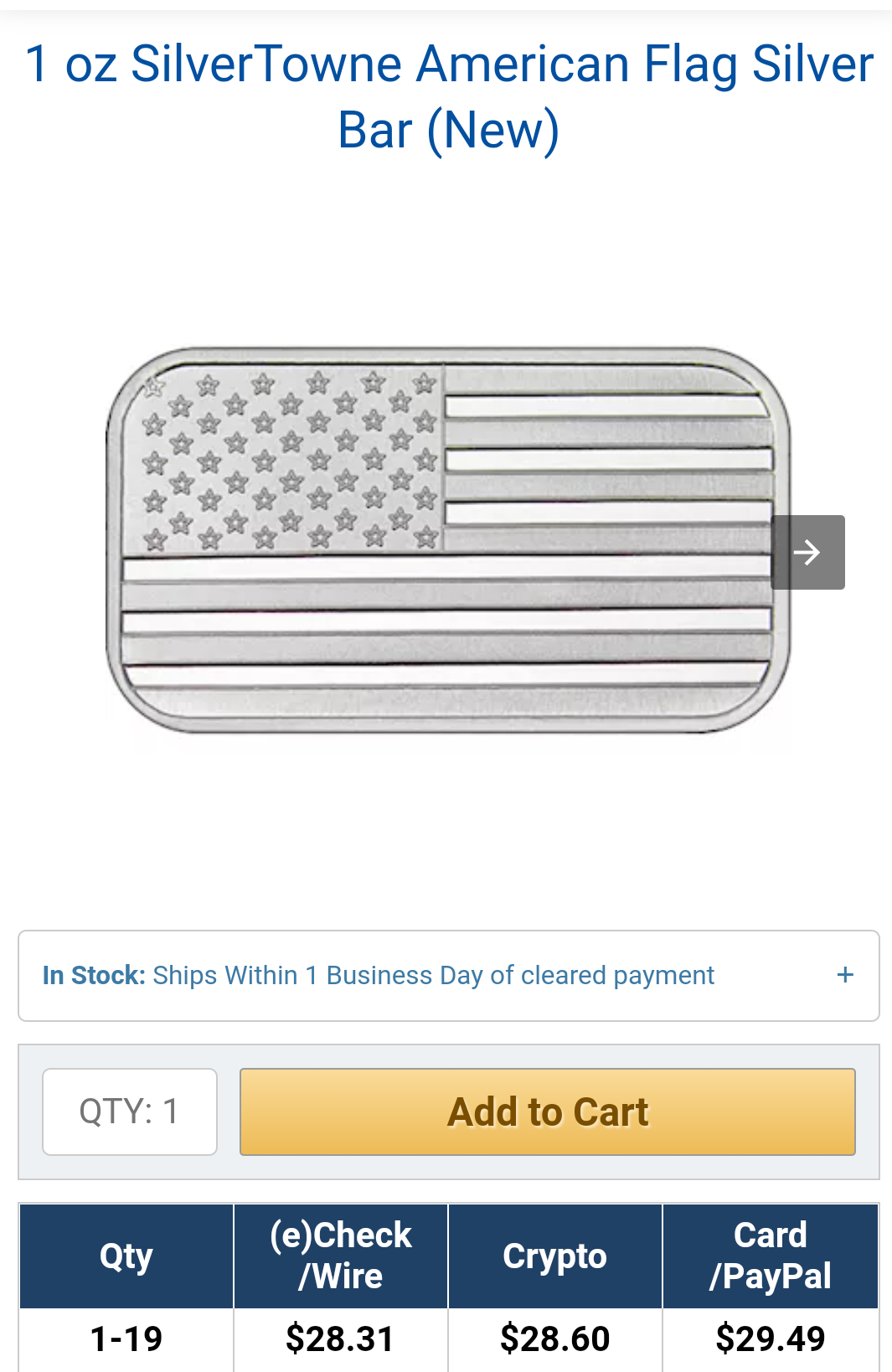

Todays Out The Door Price: which includes the sellers premium is around $28! Let’s just say for every one hundred contracts trading on silver today, that they actually only have 1 ounce of the commodity on hand if it was actually to be physically delivered! It’s Rigged.

At Top right hand corner of the chart here

https://www.usdebtclock.or... You’ll find

these numbers fluctuating daily.

Do the marh! $28 vs $1905 Upon Reset and true valuation!

P.S. Silver Eagles are Currency, so there is no tax when you exchange them for metals backed Treasury Dollars in the future! 😎

At Top right hand corner of the chart here

https://www.usdebtclock.or... You’ll find

these numbers fluctuating daily.

Do the marh! $28 vs $1905 Upon Reset and true valuation!

P.S. Silver Eagles are Currency, so there is no tax when you exchange them for metals backed Treasury Dollars in the future! 😎

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

22 June, 10:08

In response Dan Auito to his Publication

I put every penny scraped up towards xrp ......hmmmm......sooo I need to keep scraping away and buy some silver.....how much time u estimate ?? 🙏❤️ I need to help out a lot of furry creatures and some family/friends ofcourse

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

"This is not financial advice."

1) Start with generic silver/gold. More bang for buck. 2) Get the largest ounce/grams your fiat money can afford. Bigger discount. 3) Diversify your portfolio with real metal assets (aka real money). 4) When the old, corrupted banking system falls, you will have the true value of money. Or the very least, close to it (simplistic summary). Hopefully.

Even having an ounce of silver in your possession and you are ahead of the game. example:

1) Start with generic silver/gold. More bang for buck. 2) Get the largest ounce/grams your fiat money can afford. Bigger discount. 3) Diversify your portfolio with real metal assets (aka real money). 4) When the old, corrupted banking system falls, you will have the true value of money. Or the very least, close to it (simplistic summary). Hopefully.

Even having an ounce of silver in your possession and you are ahead of the game. example:

07:56 PM - Jun 22, 2022

In response Rachel T22 to her Publication

Only people mentioned by SherlockPepe in this post can reply

Dan Auito

@DanUSCG

22 June, 08:11

In response Sherlock Pepe to his Publication

Bars are considered a commodity and the whole amount of its true value will be taxed upon exchange!

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396

Sherlock Pepe

@SherlockPepe

22 June, 10:17

In response Dan Auito to his Publication

Everybody has different reasons, strategies for acquiring, selling & exchanging P.M. There's always that debate with premium vs generic. Just like with firearms; 9mm vs .45 debate: They each have their pros & cons.

People who don't have enough dollars now (mentioned above), generic silver (rounds/bars) might be it. Build immediately & have more silver. Inflation is hurting people now, a premium coin like an American silver eagle is ~25%-35%+ more than generic. Today's example (rounding cents for simplicity):

$150 budget. $28 generic 1 oz vs. $35 premium eagle 1oz.

Own 5 oz of generic silver OR 4 oz of premium silver.

That 1oz less could potentially be thousands of future dollars if the "Q plan" prevails. Paying cap gains taxes (if it still exists) will be smaller compared to the profit of owning more silver. Also, depends on individual income bracket. Again, if that even exists in the future.

45 comes back, patriots in control & the DS/IRS will be gone. Keeping the faith.

People who don't have enough dollars now (mentioned above), generic silver (rounds/bars) might be it. Build immediately & have more silver. Inflation is hurting people now, a premium coin like an American silver eagle is ~25%-35%+ more than generic. Today's example (rounding cents for simplicity):

$150 budget. $28 generic 1 oz vs. $35 premium eagle 1oz.

Own 5 oz of generic silver OR 4 oz of premium silver.

That 1oz less could potentially be thousands of future dollars if the "Q plan" prevails. Paying cap gains taxes (if it still exists) will be smaller compared to the profit of owning more silver. Also, depends on individual income bracket. Again, if that even exists in the future.

45 comes back, patriots in control & the DS/IRS will be gone. Keeping the faith.

Notice: Undefined index: tg1tga_access in /home/admin/www/anonup.com/themes/default/apps/timeline/post.phtml on line 396