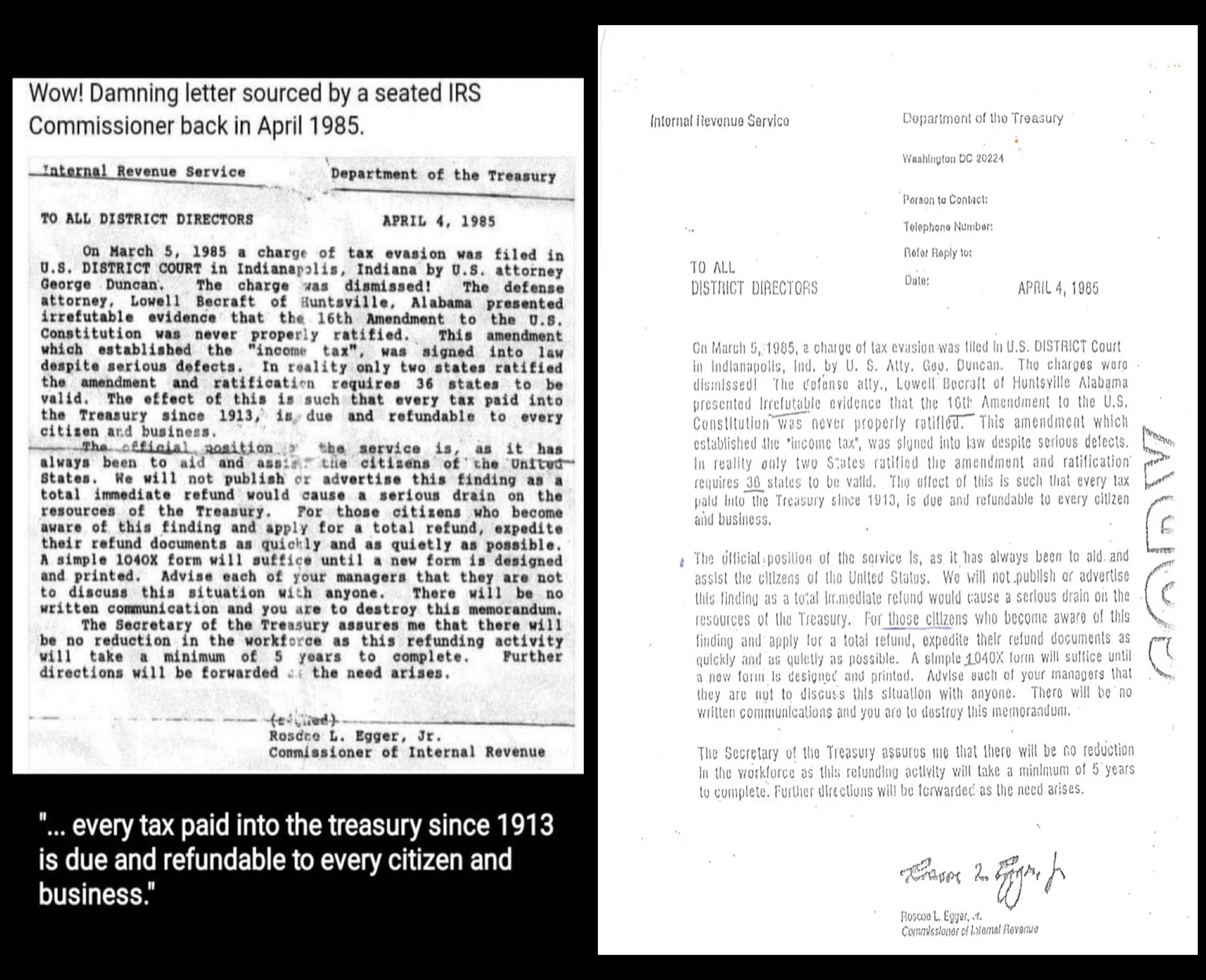

Internal memo that all DISTRICT DIRECTORS of the IRS received from Roscoe L. Egger, Jr., Commissioner of Internal Revenue, on April 4, 1985

"On March 5, 1985, a charge of tax evasion was filed in U.S. District Court in Indianapolis, Indiana, by U.S. Attorney George Duncan. The charges were dismissed! The defense attorney, Lowell ["Larry"] Becraft of Huntsville, Alabama, presented irrefutable evidence that the 16th Amendment to the U.S. Constitution was never properly ratified.

This amendment which established the "income tax" was signed into law despite serious defects. In reality, only two States ratified the amendment and ratification requires 36 states to be valid.

The effect of this is such that every tax paid into the Treasury since 1913, is due and refundable to every citizen and business.

https://12160.info/m/blogp...

https://www.govinfo.gov/co...

"On March 5, 1985, a charge of tax evasion was filed in U.S. District Court in Indianapolis, Indiana, by U.S. Attorney George Duncan. The charges were dismissed! The defense attorney, Lowell ["Larry"] Becraft of Huntsville, Alabama, presented irrefutable evidence that the 16th Amendment to the U.S. Constitution was never properly ratified.

This amendment which established the "income tax" was signed into law despite serious defects. In reality, only two States ratified the amendment and ratification requires 36 states to be valid.

The effect of this is such that every tax paid into the Treasury since 1913, is due and refundable to every citizen and business.

https://12160.info/m/blogp...

https://www.govinfo.gov/co...

08:02 PM - Feb 12, 2024

Only people mentioned by MagaMutt in this post can reply